Sanafer Arakkal, buyers can navigate each legal detail with confidence and build successful, compliant, and sustainable partnerships in the UAE. Free zones supply one hundred pc foreign ownership and supply world-class infrastructure in strategic places. However, businesses operating within a free zone are restricted from conducting enterprise outside the zone with out additional licensing. Selecting a free zone can be beneficial for international traders in search of full control over their operations. Acceleration in Dubai enterprise development as well as increased entry and protection of the markets may be ensured by way of joint ventures. You’ll be in a position to entry the clients, distribution lines, and capacities of your host associate who’s already arrange shop, dashing up the whole means of ramping up the operations.

An Offshore firm, often registered in a jurisdiction just like the Jebel Ali Free Zone (JAFZA), is a completely completely different animal. It Is not for buying and selling; it’s a legal software designed for worldwide enterprise structuring. Simply final year, a staggering 250,000 new firms were registered, pushing the total to over 1.four million. This development is part of a national push to hit two million firms by 2035, making it the perfect time for entrepreneurs to get pleasure from UAE tax advantages and get in on the motion with professional guidance.

What Are Three Way Partnership Companies?

- Whether structured as a separate legal entity or created by way of contractual agreements, joint ventures require careful planning, efficient communication, and well-structured agreements to succeed.

- Historically, international investors may personal solely up to 49%, with a local sponsor holding 51%.

- Varied kinds of joint ventures are acknowledged inside the UAE, every serving distinctive purposes and industries.

- Dubai offers numerous alternatives for international companies that goal to penetrate the UAE market by initiating a three means partnership.

- While there’s no fixed minimum capital requirement for contractual JVs, an included JV should meet the minimum capital set by the related licensing authority.

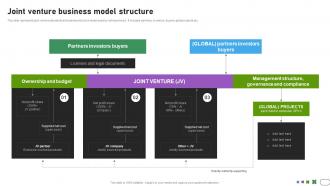

With strategic planning and professional guidance, companies can build profitable, long-term partnerships and obtain sustainable development. For professional help, Black Swan Business Setup Service is ready to support each stage of your joint venture formation journey—efficiently and transparently. Furthermore, the UAE has heavy promotional incentives for buyers and has supported entrepreneurship as a key part of its International Direct Investment (FDI) technique. A three means partnership in the UAE is a business arrangement where two or more events agree to mix resources—such as capital, expertise, experience, or market access—to operate a project or commercial exercise collectively. The partners share profits, risks, and management obligations according to a legally binding three means partnership settlement (JVA). Dubai-based corporations function beneath a layered structure combining federal UAE legislation, emirate-specific laws, and free-zone authority rules.

The firm is particularly energetic in corporate governance, compliance, threat administration, and regulatory advisory, supporting purchasers with complicated worldwide operations. In company issues, Hadef & Partners advises on business contracts, shareholder disputes, regulatory points, and company governance, typically the place litigation threat is high. Its courtroom energy makes it a strategic alternative when transactional issues carry dispute potential. Hadef & Companions is considered one of the UAE’s most respected legislation companies for litigation, arbitration, and building legislation, supported by a powerful corporate and industrial advisory follow. The firm has a reputation for dealing with high-stakes disputes involving major builders, contractors, and government-related entities. A Mainland setup presents unrestricted entry to the native market, a Free Zone supplies a perfect platform for global trade, and an Offshore company serves as a strong device for asset management.

Organising A Joint Venture In The Uae: Alternatives And Challenges

This part of the journey isn’t simply filling out one type; it’s a sequence of official steps with authorities bodies, the place every one sets the stage for the following. You’re basically building the authorized and business foundation of your new business, piece by piece. For tailored assist and session, attain out to Join Group right now and take the first step towards a profitable three method partnership within the UAE. The course of can take wherever from a couple of weeks to some months, depending on the complexity of the joint venture and the regulatory requirements. The costs vary relying on the kind of enterprise, construction, and licenses required. You might want to factor in registration fees, authorized consultancy, and operational setup prices.

Mainland Vs Free Zone Vs Offshore: Legal Implications

In conclusion, while the formation of a three way partnership is a significant step, the real problem typically lies in successfully monitoring and managing its efficiency. These parts, when carefully applied, not only improve the operational success of the venture but also strengthen the collaborative relationship between the companions, paving the way for future cooperative endeavors. In conclusion, whereas the potential rewards of entering into a three means partnership in the UAE are appreciable, the complexities of the native business culture are equally important. Success in this market requires greater than just a sound enterprise strategy; it calls for a deep understanding of cultural nuances. By respecting these cultural features and approaching joint ventures with an informed and sensitive strategy, international businesses can considerably improve their prospects for success within the UAE. Lastly, an often-overlooked aspect of danger management in joint ventures is the exit strategy.

Conclusion — Creating A Powerful, Legally Safe Three Way Partnership Within The Uae

The UAE doesn’t impose corporate taxes on most businesses, except for oil firms and overseas banks, which is a significant benefit. However, with the introduction of Worth Added Tax (VAT) in 2018, joint ventures should ensure compliance with VAT laws. Structuring the joint venture to optimize VAT dealing with can lead to substantial tax savings and enhance money circulate management.

Joint ventures in the United Arab Emirates (UAE) symbolize a strategic approach for companies looking to broaden their operations, enter new markets, or improve UAE Company Registration. Step-by-Step Guide their aggressive edge by partnering with local companies. The UAE’s dynamic economy, strategic location, and favorable enterprise setting make it an attractive destination for such partnerships. Structuring a profitable three method partnership in the UAE entails understanding local rules, aligning strategic pursuits, and making certain mutual benefits for all events concerned.

声明: 本站内容均转载于互联网,并不代表57创业网立场!

如若本站内容侵犯了原著者的合法权益,可联系我们进行处理! 联系邮箱:214544430@qq.com